RevenueCat, a top subscription management platform for apps that monetize via in-app purchases, is now flush with new capital as it expands to the web. The company has closed on a $12 million Series C led by Adjacent, following the launch of a new product, RevenueCat Billing, that allows web app developers to integrate subscription purchases into any website. Later, it will also support Roku.

The timing of the product’s launch is notable, as it arrives amid the implementation of the EU’s Digital Markets Act (DMA) regulation, which is forcing Apple to open the iPhone and the App Store to new competition. As a result, Apple initially blocked iPhone web apps (Progressive Web Apps, or PWAs) in the EU, likely fearing developers would abandon its App Store, before reversing that decision under regulatory pressure.

For RevenueCat, however, the changes ahead for iOS — not to mention Apple’s refusal to cut its default 15%-30% commission rate — mean there are now more developers looking to the web to monetize their apps.

“It could be for progressive web apps or any kind of customer that wants to take payments outside of the App Store,” said RevenueCat CEO Jacob Eiting of the new web billing product. “It’s going to play within all the new [DMA] rules … it’s going to be a pretty significant product expansion for us.”

The company says it moved in this direction because of the inbound interest from developers. Even if they didn’t have a web app, many developers wanted to shift their customers to the web to pay.

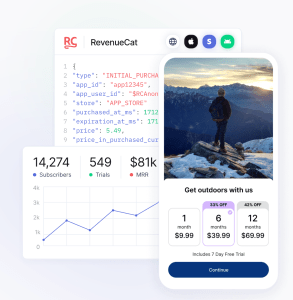

Though Stripe already enables this functionality, what developers were lacking was a system that’s specifically designed for consumer subscription apps. Now, even if developers are processing payments through Stripe or others, they’re getting their data and insights in the same format and within the same dashboard where they already manage their in-app purchase data. This makes it easier for them to focus on how their subscription apps are monetizing overall, regardless of where the payment comes from, web or mobile.

Though Apple has historically not allowed app developers to steer customers to the web from inside their iOS apps, it has permitted steering from other channels, like the developer’s website or emails to customers. The EU’s DMA rules should also permit developers to steer customers to the web from inside their mobile apps, too.

With RevenueCat Billing, essentially a web SDK, developers can accept subscription payments from any website. It joins other recent product releases like Paywall, Targeting and Experiments, which are all designed to help developers grow their revenue. RevenueCat powers subscriptions in over 30,000 apps and handles over $2 billion in subscriptions annually, it says.

The new Series C from Adjacent (led by Nico Wittenborn, a Series A investor, now board member) totals $12 million. Other investors include Y Combinator, Index Ventures, Volo Ventures and SaaStr Fund. Ahead of this round, RevenueCat had raised $56 million, bringing its total raise to more than $68 million.

In addition to fueling its new products, the fundraise will help RevenueCat expand to new markets, including Japan and South Korea.

“Our main competitor is ‘cobbling together monetization technology yourself’,” said RevenueCat CTO and co-founder Miguel Carranza in a statement about the fundraise and expansions. “In the U.S., we’ve done a good job at educating developers, product people, marketers, and CEOs on the challenges of building in-house. In many other regions, it’s unfortunately still the default for businesses to sink valuable resources into something that provides zero differentiation or value for that business’s end users. We’re investing in those regions by expanding our support for languages and local currencies later this year, deepening our relationships with local technology partners and agencies, as well as hiring in-market where possible.”

Image Credits: RevenueCat

RevenueCat is not yet a profitable company, but Eiting says that profitability is always on the horizon. The company still has the money it raised in 2021 and now has over $40 million in the bank in addition to around $20 million in ARR. It has also halved its burn rate since last summer.

“There’s so much stuff we can build by deploying capital and doing it on a profitable basis would just slow us down right now. So while there’s access to capital, which isn’t always the case … the best thing for our customers and investors is to take more capital and deploy it faster,” Eiting told TechCrunch.

“RevenueCat is too important to too many apps to risk the company driving towards a financial cliff. This may be counter to the prevailing narrative of how venture-backed companies should be built, but our investors are aligned with us and know that Miguel and I are leading the company to maximize the value for developers. Investors make more money when developers make more money,” the CEO said in a blog post. “To that end, we’re still aiming to take the company public in this decade.”